Quick Take: In distribution, partnerships still matter

Can manufacturers and distributors capitalize on the differences that complement one another as they race headlong into the digital age?

Welcome to my first “quick take” edition

I research the news, podcasts, books, and network every day through conversations, events, and social media. I’m looking for world-class ideas about the future of work, learning, society, commerce, economies, technology, and more. These insights inspire my ongoing long-form newsletter editions, published every Tuesday.

Listening to my subscribers, I’m adding something new—my “quick takes” on things that catch my attention and are worthy of yours. This is my first quick take edition. I’ll publish quick takes every Thursday for all subscribers. My goal is to share something interesting, fun, profound, or newsworthy—with a brief observation or explanation. As always, I invite your comments.

Can collaboration save the value chain?

My first quick take is a rant. I hope you don’t mind. I hope it’s relevant. Here goes.

Years ago, way back before the internet, I worked with manufacturers and distributors to create partnerships for mutual benefit focused on serving customers. Distributors had their way of doing things, and they were very skilled. Manufacturers had a different way and were also very capable.

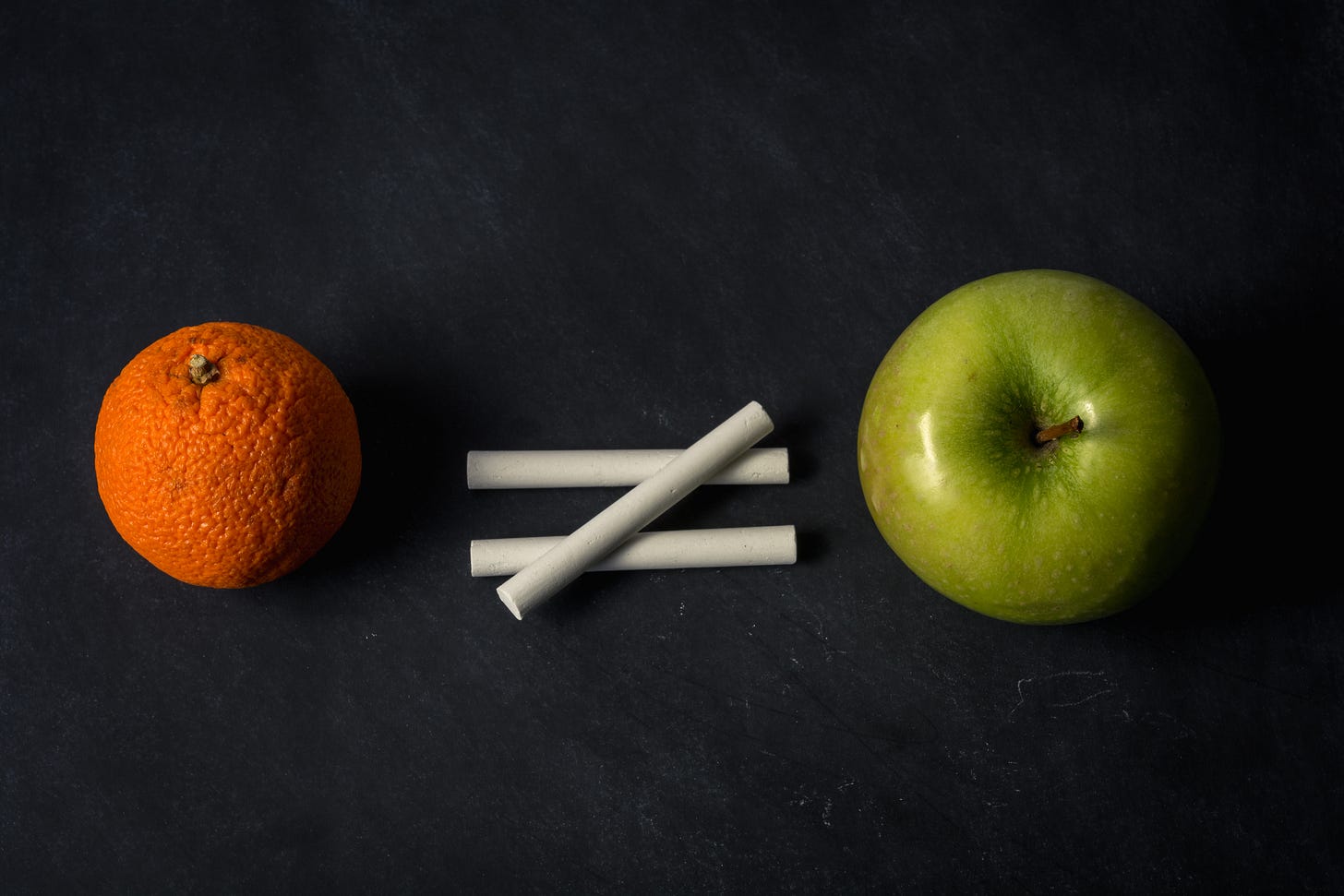

Manufacturers and distributors worked together as partners, and the partnership worked because they collaborated to bring complementary skills to the table as they worked together to create value for customers. The partnership defined the value chain.

Here’s my issue: Today, distributors and manufacturers are rushing headlong into the digital age, putting up e-commerce web stores, doing social media, leveraging artificial intelligence, and automating processes—all without any thought or consideration that each party brings something different to the table and why their differences work together to create more value for customers.

There are differences because as manufacturers and distributors develop digital tools, they do so for their own purposes—to enhance their differing business models, and to achieve their unique objectives.

I’ve asked manufacturers how their AI is different from distributors’ AI, and I’ve asked distributors how their e-commerce is different from manufacturers’ e-commerce. I received no answers, so I googled for insights. Still no answer.

THIS IS A MASSIVE ISSUE BECAUSE THE LACK OF DIFFERENTIATION IS KILLING THE PARTNERSHIP.

There is a word for partners that are not different. That word is competitor.

Manufacturers, feeling their digital oats, are acting in their interest and disintermediating distributors. Feeling their digital oats, distributors are acting in their interest and creating customer service experiences without integrated product user experiences.

Customers will suffer without intentional collaboration. Worse, Amazon will notice and take more margin and power from the traditional value chain. Given neglect, the value chain will die on its vine. As the value chain withers, both parties—manufacturers and distributors—will lose.

Distributors and manufacturers are both going digital. They must. Saving the partnership means understanding how each party’s digital version is different from the other and how they go together to serve customers better.

Digital technologies are blurring the distinctions between manufacturers and distributors. Blurriness kills partnerships. Differences make partnerships possible. Without carving out distinctive differences for the digital age, the partnership will die.

Your take?

What do you think about my rant? Am I right? Am I wrong? Are there bigger fish to fry? Are there any other topics you would like me to explore? Please share your comments below or reach me at mark.dancer@n4bi.com.

Love the comment on what partners without differences really are: competitors. For cooperation to overcome competition, there needs to be equitable compensation. Blurriness can lead to both sides imagining taking more of the total partnership margin. Say a value added distributor sells a product with hands on attention, and high margin. But, manufacturer realizes the distributor’s profit is 3–4X the manufacturers profit. Incentive to go around the current distributor? But the manufacturer has no means of maintaining a high attention sales effort. Get new distributors? Maybe kill the facilitated sales made possible by the first distributor. Blurriness on both ends.

Distributors had their way of doing things, and they were very skilled. Manufacturers had a different way and were also very capable.

So what's the difference between "skilled" and Capable"? Have you started a bias in your so-called rant?

The pandemic exposed much of we already knew about the manufacturer/distributor relationship. Distributors have to create a new narritave to remain relevant in the new digital normal world. That's the challenge, in my opinion.