Quick Take: Innovating around customer experiences

Can we de-emphasize product and service innovations and instead leverage technology for innovations that improve the customer experience?

Finding new ways to innovate

I have long held that the most potent B2B innovations will help customers transform their business for the digital age. By helping customers innovate, B2B leaders help themselves. Most companies are blind to this opportunity, or they choose to ignore it. Rather than harnessing digital technologies to help transform the customer’s business, distributors and manufacturers use them to put more products in shopping carts, replace human calls with chatbots, and reduce headcount through automation. These efforts may improve a B2B company’s competitiveness, but they do nothing to help customers compete in the digital age. In Innovate to Dominate, I pushed this idea with distributors:

By helping customers, distributors help themselves. Customers need to evolve for the digital age, but like distributors, many customers are uncertain about the future. By developing expertise around how customers will do business and helping them transform, distributors will drive their businesses forward.

I have found encouraging progress at B2B companies—distributors and manufacturers—that focus on creating revolutionary customer experiences. The best innovations think beyond traditional products and services to break precedents and remove blinders. They focus on capabilities and functions such as delivery, training, application advice, and banking.

Yes, banking! B2B companies provide critical banking services such as payment terms, discounts, and rebates. Traditionally, these offerings are conceived as encouraging customers to do business with the manufacturer or distributor. In this sense, they are a tool for selling products and services. Turning this idea on its head, forward-thinking B2B companies are developing customer experiences around delivery, training, application advice, banking, and more, on their own, independent of the need to sell products or services—leading to breakthrough innovations.

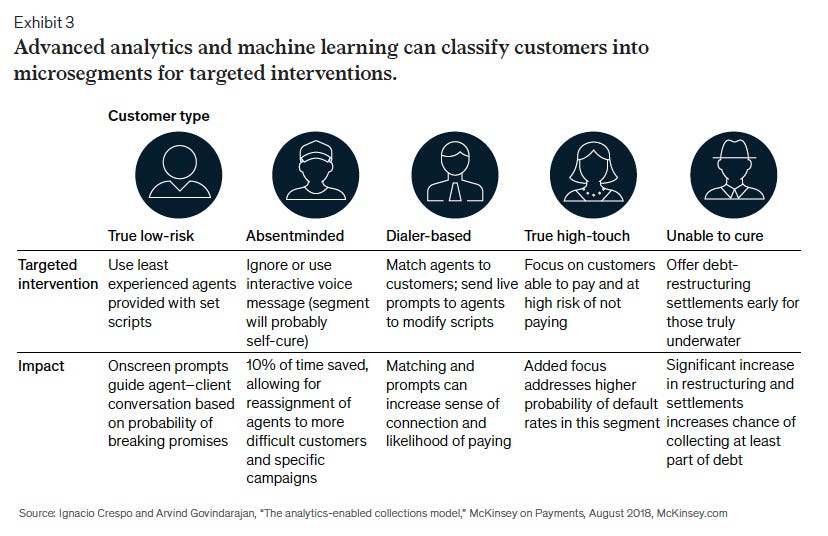

With all of this in mind, I was excited to find McKinsey & Company’s excellent paper, AI-powered decision making for the bank of the future. If B2B companies are to innovate around banking, they should aim for world-class banking capabilities. I was particularly excited by this graphic:

McKinsey’s graphic is about segmenting customers around banking needs, knowing that analytics, artificial intelligence, and machine learning can classify customers in real-time. By adopting this mindset, B2B companies can deploy customized banking services to customers according to their immediate needs. This capability will go beyond the tribal customer knowledge held by salespeople, and it may revolutionize B2B banking services to go way beyond payment terms, discounts, and rebates. When applied to other value chain functions, it may transform the legacy business models that define distribution’s role in serving customers. By leveraging technology to help customers with their banking needs, B2B companies are helping themselves.

Your take?

Are you innovating around customer experiences? Do you see other insights in the McKinsey & Company paper? Are fintech startups offering banking services to your customers? Will they usurp your role or grab your opportunities before you can innovate? Please share your comments below or reach me at mark.dancer@n4bi.com.

Mark,

What comes to mind for me when I look at the variety of the transactions I do every day, I realize that many of the routine choices I make are because I like the people providing the service and habitually buy from them. While rehabbing homes, I usually ate at the same diner where I knew the wait staff, I shopped at Menards where I felt treated much better (and consequently knew more staff than Home Depot or Lowes--their turnover seemed far too much), used the same subcontractors, etc.

This comes under the phrase, "Be easy to do business with" (just being easy going and likeable), and takes it a step further to making a personal contact. The personal connection is greatly enhanced when there is an expertise and/or solution conveyed in the transaction. ("Have you tried our {Cobb Salad}--the guys love it", or "For those materials, try this adhesive for waterproofing".)

The personal connection goes a step beyond the economics and reaches into the customer's emotions. This has the customer feeling that this is a great experience, that they have an ally solving their problems, and only incidentially about the products themself.

Are there direct connections to web sites and phone calls? Try to be creative about that. Can consultative-type selling be digitally replicated with phone banks and AI? It looks like the better the "know your customer" data that goes in, the better the output and result.

From an experience earlier this week, i was on a chat line answering questions, and the answer to the next question was already in my previous answer. Were they checking to make sure they heard it correctly? It did not seem like it. It did seem like they never read the reply because they were working too many threads. I never did get a return email to answer my question (new account), but they did want my account number.

Mark, Thanks for hosting this and posing interesting questions!